KXSF-LP 102.5 FM

San Francisco Community Radio

A broadcast service of San Francisco Community Radio, Inc.

Megatrends

Mar 6, 2024 12:00 PM – 2:00 PM

Music

With Patrick Fahey

The Black-Scholes-Merton Equation has been called Trillion Dollar Equation for good reason. In the decades after it's development in 1973, this formula spawned four multi-trillion dollar industries, today's global derivatives markets. In general, by betting on the future is risky since you can't rely on the past as a guide. But the BSM model was developed to help stock market gambler to "guess right" most of the time on what are called "random walks". The rule of thumb of stock market investment: you can't ever determine what happens tomorrow, but in the long run, a line passing through the ups and downs is always positive, meaning, in the long run, you always make money. The "casino economy" aficionados use modern mathematical theories to win more often than not in shorter time domains.

The BSM model was the result of over 100 years of development of assumptions of Wall Street and European stock market behavior. This equation originally came from physics, understanding how heat is transferred, and how to beat the casino at Blackjack! This equation mirrors Einstein's first PhD thesis on Brownian Motion, how atoms cause the random motion of yeast particles. So it's no surprise that the first people to discover the secrets of Wall Street weren't stock jocks and day traders, but physicists, scientists and mathematicians. So how does this all work? And are there any downsides to applying mathematics and physics willy nilly to a gambling on Wall Street?

What is the downside? As Economist and Democratic Senator Elizabeth Warren warned: Wall Street's biggest gamblers, if unregulated, use the banks to gamble with of OUR money. If they win, they win big; if they lose, taxpayers pay: they capitalize the wins and socialize the losses. When they lose BIG--as in Wall Street crashes in 1987, 2000 and 2008, we the taxpayer were forced to bail Big Banks out. Even worse, as we suffer through the economic recovery, the top 1% accumulate most of the recovery for themselves. In Savings & Loan Crisis in 1987, the top 1% enjoyed 56% of the recovery; in the crash of 2000, the top 1% enjoyed 78% of the recovery; in the 2008 mortgage crisis, the top 1% accumulated 92% of the recovery. Meanwhile, more than 24 million families lost their homes and life savings. President Obama, could have stuck it to the Big Banks to finance the mortgages of those 24 million families--so the banks got paid anyway--but he chose to bail out the banks, with the advice from Larry Summers. Even worse: "In 2009, Wall Street bankers were on the defensive, worried they could be held criminally liable for fraud. With a new administration, bankers and their attorneys expected investigations and at least some prosecutions."

As Economist and Democratic Senator Elizabeth Warren warned: Wall Street's biggest gamblers, if unregulated, use the banks to gamble with of OUR money. If they win, they win big; if they lose, taxpayers pay: they capitalize the wins and socialize the losses. When they lose BIG--as in Wall Street crashes in 1987, 2000 and 2008, we the taxpayer were forced to bail Big Banks out. Even worse, as we suffer through the economic recovery, the top 1% accumulate most of the recovery for themselves. In Savings & Loan Crisis in 1987, the top 1% enjoyed 56% of the recovery; in the crash of 2000, the top 1% enjoyed 78% of the recovery; in the 2008 mortgage crisis, the top 1% accumulated 92% of the recovery. Meanwhile, more than 24 million families lost their homes and life savings. President Obama, could have stuck it to the Big Banks to finance the mortgages of those 24 million families--so the banks got paid anyway--but he chose to bail out the banks, with the advice from Larry Summers. Even worse: "In 2009, Wall Street bankers were on the defensive, worried they could be held criminally liable for fraud. With a new administration, bankers and their attorneys expected investigations and at least some prosecutions."

The wildly crazy thing about the world that the BSM equation aht wrought: The size of today's global derivatives market is huge. How huge? In the hundreds of trillions of dollars. The size of the global derivatives market is MANY TIMES larger than the world GDP. The size of the global derivatives market is orders of magnitude greater than the underlying securities upon which it is based. The gross domestic product of all the nations on Earth is less than 1/10 that of the assumed value of the global derivatives market. Let that sink in a moment.

| 12:00 PM |

| Charlie Haden & Pat Metheny The Moon Song Charlie Haden Simple Ensemble Independent 2015

|

| 12:19 PM |

| Klobas Kesecker Ensemble 5 Scapes Moment's Notice Klobas/Kesecker Ensemble 2014 Jazz

|

| 1:00 PM |

| Klobas Kesecker Ensemble Sima Tommy Kesecker Blues Elixer

|

| 1:20 PM |

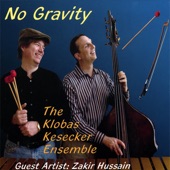

| Klobas/Kesecker Ensemble Five Scapes Klobas Kesecker Ensemble No Gravity Klobas Kesecker Ensemble 2008 Jazz

|

| 1:20 PM |

| Dave Lippman Friend of the Fetus Carole Rose Livingston Friend of the Fetus 1421189 Records DK 2019

|

| 1:53 PM |

| Charlie Haden & Pat Metheny The Moon Song Charlie Haden Simple Ensemble Independent 2015

|